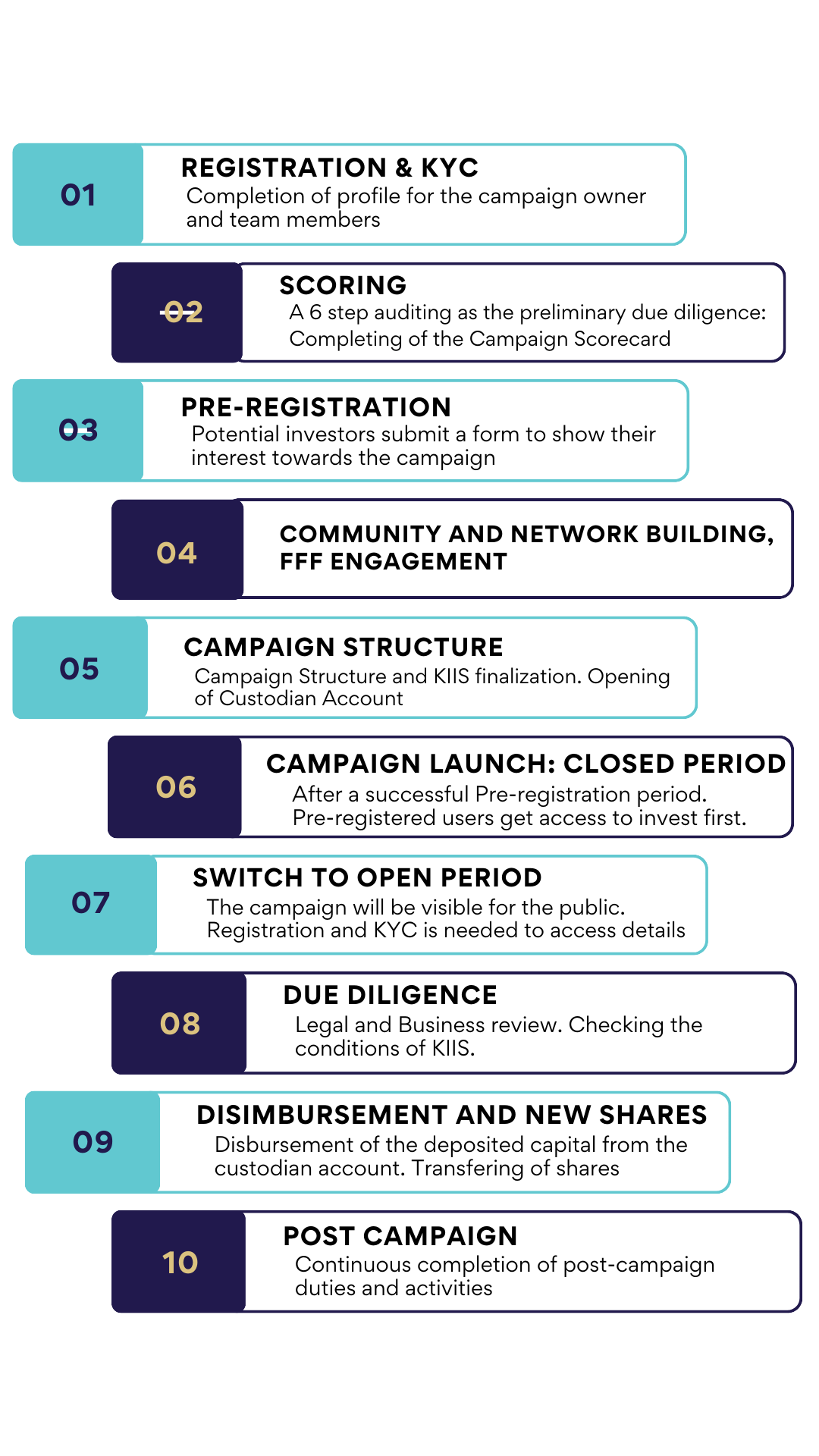

On this page, you will find comprehensive information about what crowdfunding is, to whom we recommend it, and how it works, and you can also click through to the first task of the campaign launch process.

At the bottom of the page, we included a few more useful articles from which you can learn about the valuation of startups and more about crowdfunding, and proceed to the Q&A as well.

Studying the below information does not substitute studying the General Terms of Use.

TOKE’s value proposition for Founders:

-

Fast: 2-3X faster than any other form of investment. As of August 2024, our investment capacity is between EUR 0.5M to 1 million/month, This capital can be disbursed within 2-3 months from the time of signing the contract. No minimum campaign size is required.

-

Efficient: two benefits in one. Practice shows that a Crowdfunding campaign combines marketing/user acquisition and funding at once. Your potential customers/users can become your investors and vice versa.

-

Savvy: As many startups are struggling to get medium-large tickets from investors in crowdfunding- small tickets add up to a large. it is the only way to collect small tickets efficiently, and the only method to make clients and buyers finance you.

-

Flexible leverage: The crowd as a co-investor: Great for a bridge round or as a supplement and leverage any angel/VC investment without damaging the cap table, as an SPV can be created.

-

Success-based fee campaign: a very competitive fee that will cost you much less than your own marketing campaign. (And there is a choice of a flat fee or success fee based campaign service).

-

Minimum risk to be taken: at a cost maximum of EUR 2k (including marketing costs): at TOKE, you can launch a pre-registration campaign to ‘test the waters’, assessing what range of prospective investors are ready to commit. If that within 3 weeks turn out to be unsuccessful, you can withdraw from the contract.

-

Top notch service and assistance: TOKE offers personal campaign management services, on a weekly online meeting-based manner, for free. We will support you is building the momentum that requires focus and project management, as outlined in the campaign launch contract. Assistance in the completion of the documentation, including the scoring and the basic due diligence, and during the transaction, as well as in the post-campaign investor reporting, is almost for free. Legal costs are not included, but pre-negotiable.

-

Incubation and mentoring services: for early-stage or idea-phase enterprises, we provide unique incubation and mentoring services in such a way that only contracted persons can access the draft materials in the data room and comment on them.

-

Acceleration and business development services from our global team, as we believe in the long-run success of our investment portfolio.

-

Issuance of debt-based securities and convertible loans with an annual limit of €5M. There are countries, such as Hungary, that otherwise limit the issuance to a much lower level, but ECSPR is exempt from such limitations. (The implementation of this service is in progress.)

-

Secondary trading: Investors buy and sell offers are displayed on website and we assist in completing the trade, thus will a secondary liquidity be provided.

-

Our strong community-based Mentorplatform: we organize a mentoring event monthly. Our mentors provide two hours of pro bono mentoring per month to our contracted clients, Campaign Hosts. On the same page, we also provide good visibility opportunities for our Partners in our newsletters, events, and on our social media channels.

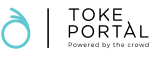

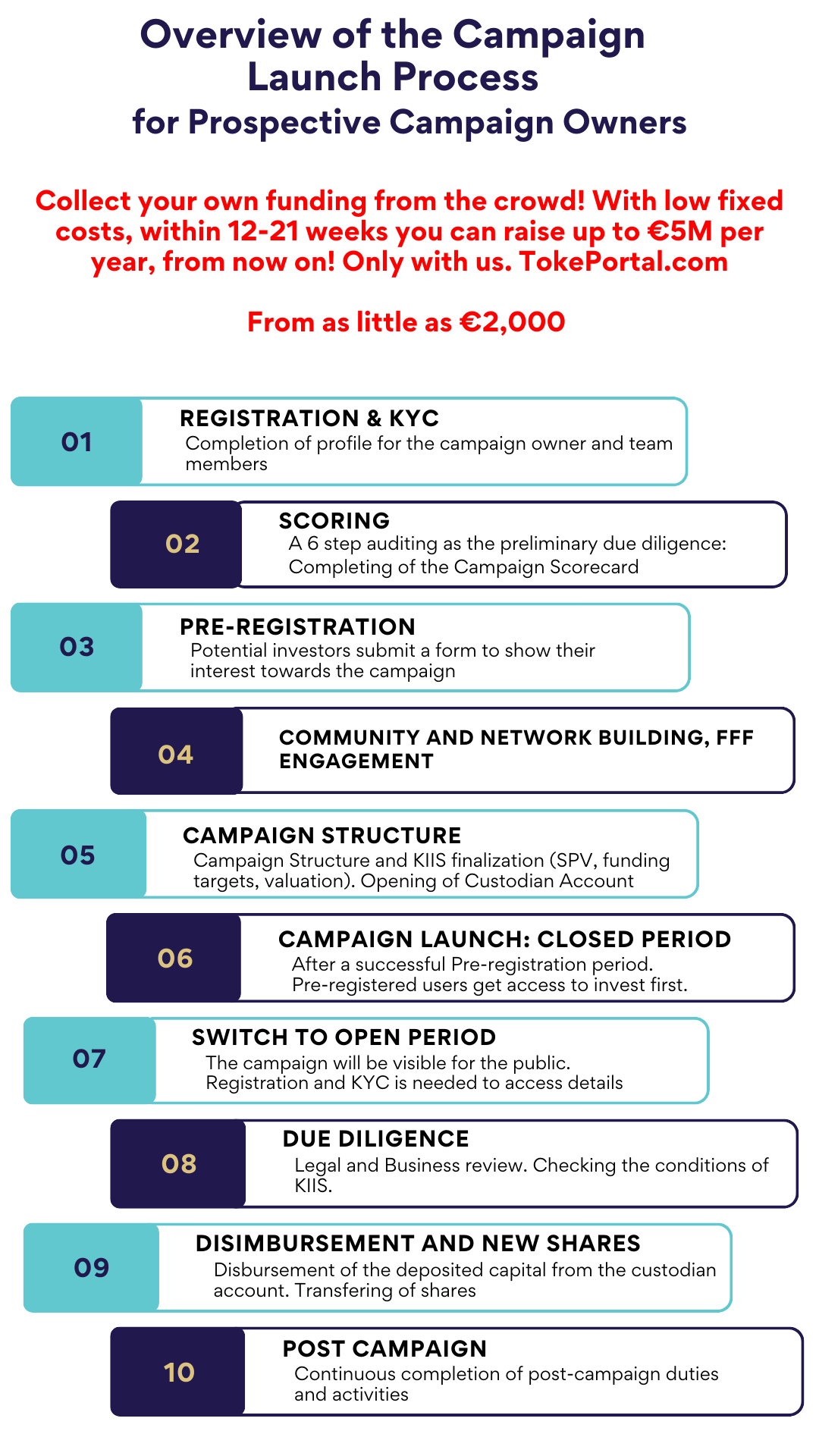

Raise the necessary capital from your followers and community! With crowdfunding, you can attract capital within 12-18 weeks, now up to €5,000,000 annually.

Starting from just €2,000!

(This is the amount you should budget for.)

The Campaign Launch Process

The Campaign Launch Process in detail

Submission of Application Online

Registration on the Platform

Personal or Online Introductory Pitch

During an in-person or online introductory pitch, crowdfundability or investment-readiness is previewed by the TokePortal team. The Campaign Launch and Cooperation Agreement (CLA) is presented).

Signing of the Campaign Launch and Cooperation Agreement

Deciding between the fixed fee and the success fee-based structure (6,5% success fee and 3% carry free until the end of the Campaign Period, as detailed in the Pricing Policy (PP). 20 hours of TokePortal’s work until Campaign Launch, and 10 hours after Campaign Closing is included in the price. Further hours are charged with a discount price of EUR 50/hour.

Weekly Meetings

Scheduling weekly meetings (until Campaign Closing) with the dedicated Campaign Manager. Memos are to be prepared/accepted by the Campaign Owner the same day. Monthly, a Certificate of Completed Services (COS) is issued. These include the number of hours incurred after signing the NDA and the contractual as well as pre-agreed ad-hoc costs. The COSs are issued quarterly for 3 years following the Campaign Closing.

Pricing, validation, peer Group Analysis

Comparison with relevant international peers (crowdfunding campaigns) for the purpose of validating the enterprise value (pre-money valuation) and for learning purposes.

Scoring

Included in the CLA fee, the Pre-campaign audit service is carried out by contracted Partners and Mentors of TokePortal that are introduced to the prospective camping owners.

The audit is carried out in the following 5 steps, until the completion of the Scorecard. The scorecard can include red flags, and recommendations that the Campaign Owner shall respond on, and take action in order to improve the value proposition until the Campaign Launch, or, at the latest, until the Closing, but before Reimbursement. It is highly recommended that Campaign Owners regularly consult with the advisers throughout the Campaign.

-

Legal DD: Criteria check – Incompatibility, “red flags”, necessity of SPV, basic due diligence is carried out. At Campaign Closing, a full-scope diligence is carried out, and in case of the red-flag-free report, the collected capital can be released from the Custodian account. Within a year after the Closing, another legal audit is carried out.

-

HR: The suitability of the team and the founders are leaders is reviewed. Within a year after the Closing, the HR strategy is reviewed.

-

Business and financial plan: Business model, risks, financial plan / pre-money valuation check is completed.

-

Online marketing suitability: Assessment of online marketing capabilities, checking online presence, activity, and reputation. An efficient online marketing strategy must be designed and carried out.

IT: For tech projects, a thorough documentation-based check is completed

Preparation of the Campaign Management Plan (CMP)

It is the Campaign owner’s, its Founders and its Team’s most important task to “unlock the network effect”: to involve friends, family, followers (FFF) into the Campaign simultaneously with enlarging the network efficiently,

Publication of the Pre-Registration Page

The Pre-registration phase is regarded as “testing the waters”: within 3-4 weeks, with active marketing activity, and with a budget of about 1-2k euros, the whole network shall become aware and interested in the Campaign. Subscribing to the newsletter of the Campaign does not impose obligations, but it is a very good source of information about the potential success of the Campaign. In this phase, no investment takes yet place.

Pre-Registration Phase (3-4 Weeks)

During pre-registration, within 3 weeks, indications of interest must be collected to reach to the Minimum Capital. Consultations with mentors should be conducted and the search for a lead investor should begin.

Finalizing the Campaign Structure

During the Legal audit, it is decided if an SPV shall be set up to collect the investments. The Campaign owner decides for the pricing as well: how much ownership it offers against the capital.

Meeting with Relevant Mentors

Meeting with relevant mentors is not only advisable, but compulsory and free. Choose your favourite mentors from Mentorplatform.hu. Start to look for a potential lead investor as well.

Creation of an SPV and the Custodian Account

If the legal form of the Campaign Owner is not suitable for the issuance of transferable securities (shares, convertible bonds), then an SPV will be interposed according to the relevant laws.

During the Campaign, the capital is collected onto a Custodian account until the Disbursement. The Custodian shall be contracted that accepts the conditions of TokePortal.com and shall ensure a view access to the account.

Marketing Activities

According to the Campaign Management Plan to be prepared by the Campaign owner, proactive, campaign-focused communication and collaboration with TokePortal are key factors to a successful campaign. Marketing activities social media and internet-based lead campaigns, and include webinars, newsletters, pitch events, etc.

Completion of the Campaign Documentation incl. KIIS

Preparation of campaign documentation: the KIIS (the ECSPR equivalent of a Term Sheet) and additional marketing materials (presentation material, one-pager, business plan, campaign video, perks) shall be completed during the Pre-registration period.

Creating a Stripe Account

The Campaign Owner opens their own Stripe account, which is linked to the Campaign Page.

Non-Public (Closed) Phase - 2-3 Weeks

In the closed phase, only pre-registered users can invest. Early investors are the most valuable in the campaign, thus they receive special discounts at this time.

The closed phase can be launched when

-

the pre-registration landing page reaches a minimum of 500-1000 visitors per week,

-

the pre-registered capital reaches the Minimum Target Capital and

-

consultations have been held with at least 3 mentors, (etc.)

-

COS’s are signed and bills (if any) are paid.

In this phase, the Lead Investor shall be contracted with a minimum ticket of EUR 10-30k.

Online Investor Meetings

Using the links provided by TokePortal, recorded Investor Meetings are held every three weeks. Content and communication thereof is planned precisely content and afterwards a summary. This newsletter, along with the weekly newsletter, converts the most.

Storytelling, Momentum Building

According to research, prospective Investors are convinced with a of 7-10 marketing actions or impulses. Therefore, the Campaign Owner’s storytelling must continuously build momentum. Mentors can help with this as well.

It is essential to understand what “campaign” means. :)!

Lead Investor contracting

The Campaign Owner must find a Lead investor to represent the crowd in the Post-transaction decision making. The proposed person or persons shall invest at least 15% of the minimum capital “to have skin in the game”, and to be approved by TokePortal. A tripartite agreement sets forth the rights and obligations in line with the KIIS. The Lead Investor acts on behalf of the other investors, representing them in the decision-making process of the Campaign Owner. The open phase can only be initiated in the case of a signed agreement (or in case of verifiably advanced lead investor negotiations).

Open Phase (4-6 Weeks)

Provided the Campaign Owner dedicatedly performed the pre-launch tasks very well (as set forth in the CMP), then the Open (public) phase ‘just’ needs to be pushed through to the finish. Thus, preparation is the most important. During the weekly meetings, all help is offered by TokePortal to review and update the campaign. Continuous and conscious marketing activity is essential.

After reaching 50% completion, the Campaign Owner shall start with preparing for the legal and business Due Diligence to secure the funding as soon as possible.

Closing (3-6 Weeks)

After a Successful Campaign Closing (ideally earlier), the due diligence process begins, conducted by the lawyer and the financial expert of TokePortal, along with the preparation of Transaction documents required for submitting the capital increase at the Company Court where the Campaign owner’s registered office, and begin to prepare the issuance of shares. This phase – with proper preparation – can also be very quick.

TokePortal compiles and shares investor data with the Campaign Owner. With this, TokePortal has fulfilled its contractual obligations.

Campaign Owner has fulfilled its Campaign-related obligations with submitting

-

the Shareholders’ Registry after having allocated all shares to the Investors

-

Concurrently with the submission of the share register, the Campaign Owner also reports the status of the fulfillment of the incentives and gifts promised in the Campaign.

Payment of Success Fees

Success Fee (6,5%) is payable within 15 days following the Last Day of the Campaign, based upon the indicated capital at the end of the Last Campaign Day. (The reason for this deadline is that the fulfilment of the Disbursement Conditions – which are contained in the KIIS and CLA – largely depend on the Campaign Owner.)

Issuance of Shares

After the Court of Registration registers the increase in capital, the transaction lawyer initiates the share issuance procedure. At this point, all conditions for Disbursement are met (on a DVP basis, i.e., delivery versus payment) and the capital is released from the Custodian account to the current account of the Campaign Owner.

Future sell or buy orders of the shares can be submitted to TokePortal, that will display it on the platform and connects prospective buyers and sellers via email, who can complete an OTC transaction.

Post-Campaign Tasks and Activities, trading

After the Disbursement, TokePortal continues a quarterly overview of communication with investors for another 3 years, in accordance with its investor protection duties, in the interest of both the invesors and the Campaign Owner. This maintains investor trust and can even facilitate the launch of a subsequent campaign. Depending upon the capital collected,

-

maximum 2 post-audits are conducted as indicated above at Scoring,

-

within a month of each quarter, the Campaign Owner compiles a simple report in a pre-submitted newsletter about the advancements of the forecasted business development compared to the Campaign Documentation, including a general ledger extract.

-

GTC and the Complaint Policy handles events of unfulfillment or complaints.

Articles about crowdfunding, the campaign, company valuation, and regulations, such as:

-

https://www.seedrs.com/insights/investing-features-insight/tips-equity-crowdfunding-success

-

https://www.seedrs.com/academy/startup-valuation-calculator

-

https://www.startengine.com/blog/equity-crowdfunding-strategies-for-startups/

-

https://academy.musaffa.com/success-stories-in-equity-crowdfunding/

-

https://tokeblog.hu/en/everything-you-need-to-know-about-startup-valuation-methods-1/

-

https://tokeblog.hu/en/the-new-era-in-european-capital-markets/

-

https://tokeblog.hu/elet-az-ipo-elott/